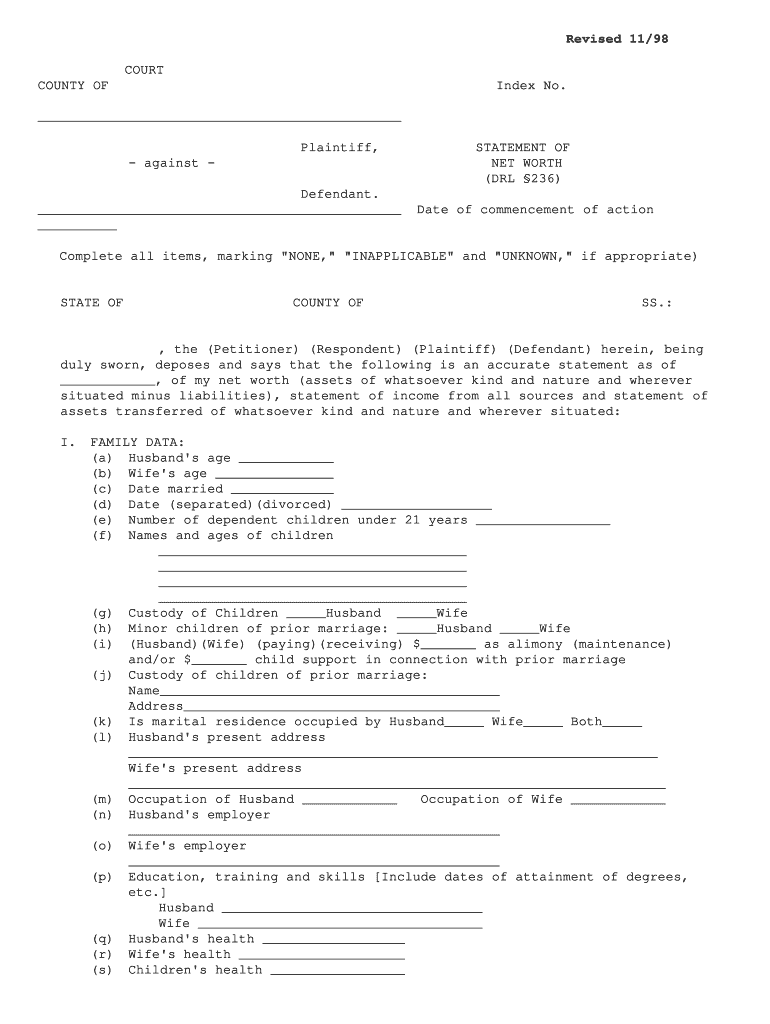

Your net worth is the difference between your assets minus your debts. A net worth statement is a financial snapshot that shows your financial wealth at a given point in time and provides a useful summary of your financial affairs. New York Statement of Net Worth, DRL 236.

There are several important reasons for developing this kind of a financial profile. Keeping such a statement from year to year can help you determine if you are accruing wealth over time or are living beyond your means. A statement of net worth can indicate if you are prepared for any kind of a financial emergency, and may be useful in determining how much home insurance you may want to consider purchasing, or how you are doing with your retirement savings.

You may be also be required to fill out such a statement for applications such as a home or an auto loan, or in dealings with the New York Unified Court system. Both spouses may be required to fill out a DRL 236 form for situations including disputes related to child support, alimony and other aspects of divorce.

To learn more about the process of filling in the New York Statement of Net Worth , check out this tutorial video, then click here to start filling out, saving, and submitting your own copy.